[ad_1]

Dalio further says: “Should the United States weaken its currency status, other countries also will have weaker currencies and then there would be an emergence of alternatives such as most importantly likely gold or currencies that tend to depreciate together. If you have a lot of debt and the United States has a lot of debt that most importantly results in a lot of sales of debt, that money probably has to be printed. For the US dollar to lose its status relative to other countries would require another currency to become dominant.

You always look at the world based on five factors – economy and credit, internal peace and conflict, external issues between countries, climate change and technology. If you have to look at the mechanics of the world, rather than giving an audience a fish to eat, if they have to know the trick of how to catch the next fish, how would you put your thoughts into play and explain some of these pointers, the number one being economy and credit?

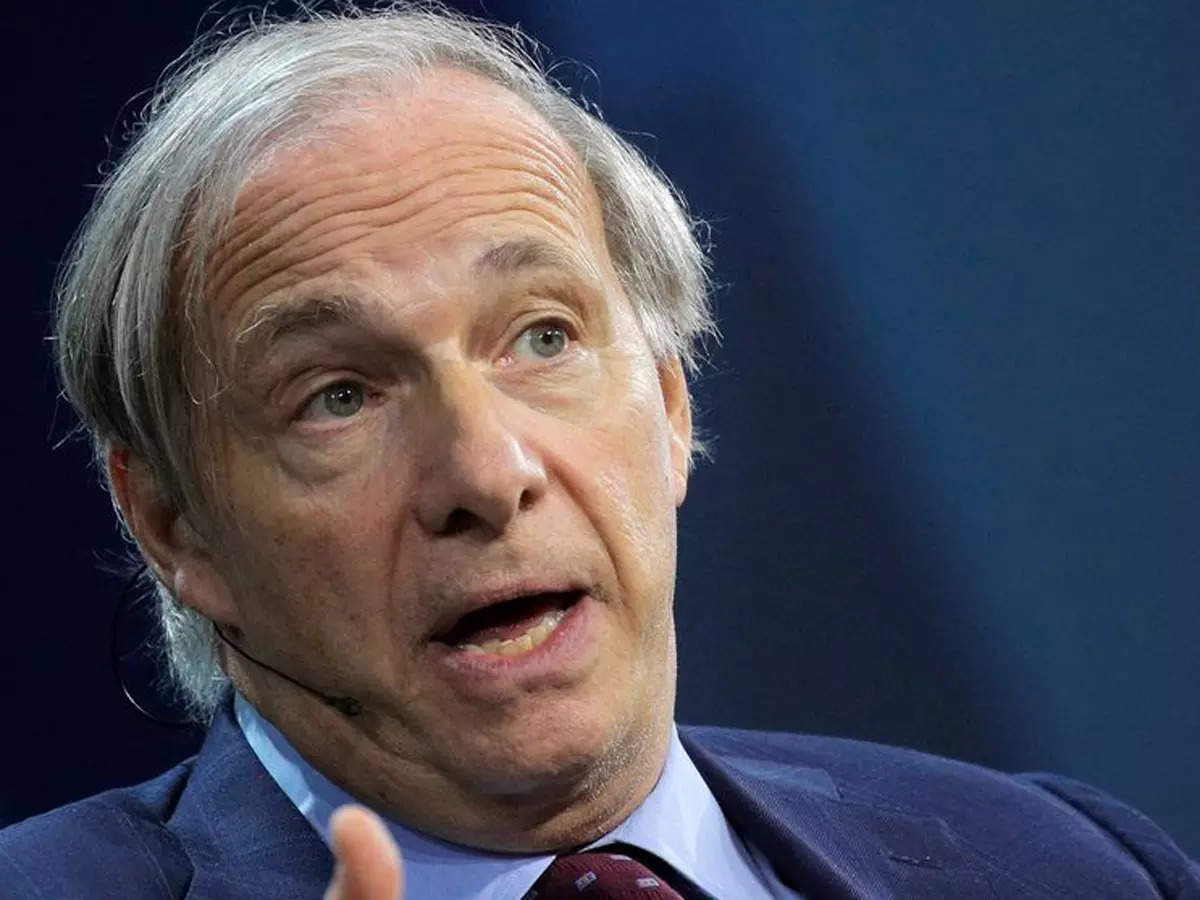

Raymond T Dalio: Yes, you are right. My goal is to explain the mechanics of this and then we can reflect on what is happening. I am a practical investor who has to make macroeconomic investment decisions every day and I learned in my life that many things that surprised me did not happen in my lifetime that happened many times in history.

Unlock Leadership Excellence with a Range of CXO Courses

| Offering College | Course | Website |

|---|---|---|

| IIM Kozhikode | IIMK Chief Product Officer Programme | Visit |

| IIM Lucknow | IIML Chief Executive Officer Programme | Visit |

| IIM Lucknow | IIML Chief Operations Officer Programme | Visit |

There were three big forces that drew my attention to study history of the last 500 years and then I discovered the other two of the five. But the first is to understand the mechanics of credit, money, debt, and economics. In other words, credit gives buying power. Credit also creates debt. Debt has to be paid back. That debt has to be paid back with hard money or soft money because they print more money. If that debt goes to create productivity, it raises living standards and it is successful.

So, that dynamic has happened but in a most important way in the United States which is the world’s treasury market that the interest rates all around the world are operating by producing an enormous amount of credit and debt and are continuing to produce an enormous amount of credit and debt that is having an effect on the interest rates and the money markets and the economy which we will go into in a second.

That very much relates to the internal political issue. When we talk about internal, we are dealing with conflict internally. It is particularly important in the United States but it exists in every country. That internal populism has emerged particularly in the United States in which there is a populist meaning almost an extremist of the left and extremist of the right that have irreconcilable differences. We are going to have not only an election but a risk of unacceptable conflict in that political situation and the social situation that exists in varying degrees in different countries but particularly in the United States most importantly.

And then of course, there is the third influence which is the change in the global world order, the relative power of countries and how the system works. In 1945, we created the world order that we are in. The way these world orders develop is there is a great war and then the dominant power and powers decide how that works. And then there is a system. The reason that the United Nations is in New York and the World Bank and IMF are in Washington, D.C. is because of that dominant power. And that world shift is taking place and India, of course, is right in the middle of that. That dynamic operating with the financial and the internal conflict creates a classic dynamic that we have seen repeat over time. Number four is droughts, floods, and pandemics, acts of nature, have caused more deaths and have caused more falls of governance systems, of orders, than any of the other ones. And we see that with climate change and the costs of climate change, just the financial costs of climate change that is a big consideration. And of course, over time, number five is the inventiveness of mankind and that goes with new technologies.

We are seeing this dynamic play out. And what I saw and covered in a study of mine, which is then written in a book called The Changing World Order. I did a video on it also. You see these patterns happen over and over again. So when we look at them, interrelationships are very important.

You have your proprietary models in which you look at the country, productivity, as well as you predict the growth. So based on your internal models, where does India stack up? From fragile five, India is now in the top five in the world.

Raymond T Dalio: In my book and again called The Changing World Order, we used statistics that go back mostly for many years to predict the next 10 years growth rate. And India is projected to have the fastest growth rate in the world of any sizable economy. And that is why the basics, what are the basics? You are seeing a combination of the development of a middle class. With that development, you are seeing vast improvements in education levels and in infrastructure. Here we are also seeing capital formation, which enables that combination of education, efficiency, improved efficiency.

With that capital formation creates the opportunity for people to be very productive. At the same time, measurements like what is the cost of an educated person? This is across societies, very attractive in India. Also civility, do you have order? There is great disorder now in a number of countries and it is worsening in the United States.

There is this ability to have that population. Demographics play a role too, of a relatively young population. And so another factor is always key and that is to be neutral or to be not in the midst of conflicts, such as the conflicts that exist between the United States and China. So all of these are measurable and they indicate a growth rate and it cannot be precise, but in the vicinity of per capita growth rate and there will be growth in the population, it will be somewhere in the vicinity of 6.5%, give or take a little bit. And that will be the strongest in the large economies.

In your book, you always refer to history as a benchmark which is that there was a time in the world when guilder was the reserve currency in the world. Then, that moved to franc, to the Great Britain Pound, now dollar. But looking at the state of the US debt, what are the chances, and the audience wants to really hear your views on that, what are the chances that the US dollar could lose its reserve currency status?

Raymond T Dalio: What happens in the United States is should it weaken its currency status, you would see other countries also have weaker currencies and then there would be an emergence of alternatives such as most importantly likely gold or currencies tend to depreciate together. But it is true that what happens in the United States or in history, there is a financial component.

If you have a lot of debt and the United States has a lot of debt that most importantly results in a lot of sales of debt, that that money probably has to be printed and where there is a squeeze emerging…. and so the picture of the US dollar is one in which…, to lose its status relative to other countries would require another currency to become dominant.

The fact that they all can go down relative to goods and service prices as there is printing of money is the more likely scenario and that would mean a greater inflation rate. I would pay attention and bonds of particularly over-indebted and fast-growing debt-indebted countries should be avoided. Productivity should be invested in that.

You always advocated the mantra of diversification. So, for the next five or ten years, what should be the approach for investors where they can maximise returns?

Raymond T Dalio: One of your three key words was diversity. I would say the important thing is generally speaking to invest in innovation and productivity, those productivity activities, and avoid indebtedness, debt assets, minimize the debt assets and then to diversify into various locations.

No one asset class, no one country, no one currency should be concentrated in because of the nature of that. So, look at those good places and then look for good leadership. I must say that your leadership, particularly Prime Minister Modi’s leadership and the stability and the support, the broad level of support, is a very important thing. So, the three things I look at are first, it is the country, if I am looking at a country, but it is true for businesses as well, do they earn more than they spent? Now, the financials are good. Do they have internal competitiveness and cohesiveness so that there could be healthy competition to raise productivity?

Number three, are they in the middle of an international conflict or are they more neutral? Those environments in which they have their sound finances, productivity with people working together in a civil way and those minimisations of the risks of international conflict are the fundamentals that I look for.

You are bullish on India. Fundamentally, it is a good place to be in. Growth is enviable in the world. What will it take for your firm to come to India and invest either in the equity market or the real estate market or the debt market? What kind of regulations would you say are important for you to come here?

Raymond T Dalio: We are primarily liquid investors and the public markets have some issues to be dealt with. They are relatively illiquid. They are still overregulated. There are issues about taxes. There are concerns about capital controls and as a result foreign investment in your government bond market, for example, is only 1% of the bond market.

In terms of corporate bond markets, only 2%. That results, by the way, in interest rates being higher than they ordinarily would be if it was more open. So, there needs to be the development, the type of reduced regulations that you have seen in other aspects of the markets and the economy, reduced regulations, increased efficiency, all of those reforms would be very beneficial for that stock market or the bond market. Those are the things that are needed.

I am tempted to share a secret. Are you guys ready for a secret of Ray Dalio? Ray Dalio meditates every day. Ray Dalio believes in the power of meditation and Ray Dalio I would encourage you to share your experience about meditation.

Raymond T Dalio: Meditation has had more of a beneficial effect on my life than I think almost anything. It has given me the equanimity, the centeredness, the clarity of thought to be able to approach all the issues in a much better way and it has also given me health. It reduces stress and so on. Meditation, I give meditation to people. I have teachers teach them because it is the best gift I can give anyone.

(You can now subscribe to our ETMarkets WhatsApp channel)

[ad_2]

Source link