[ad_1]

“The scheme of merger is flawed and bridled with irregularities,” said the Quantum letter signed by its CEO Jimmy Patel. “The swap ratio will result in a net loss of at least ₹1,776 crore to ICICI Securities minority shareholders, including at least ₹61 million to the unit holders of the schemes of Quantum Mutual Fund.” The letter was also sent to ICICI Securities and ICICI Bank in addition to the Securities and Exchange Board of India (Sebi).

Quantum raised questions about ICICI Bank’s claims that it has received certain exemptions from Sebi for the delisting proposal. The fund house had voted against the proposal in the voting process that ended March 27.

“We are unaware of the representations made to SEBI for seeking exemption based upon which SEBI has accorded its sanction,” the letter said. “We hereby call upon you to provide us with a copy of the application(s) and order passed by SEBI granting exemption from strictly complying with the Delisting Regulations.”

Quantum confirmed it has complained to Sebi on the matter. ICICI Bank and ICICI Securities did not respond to ET’s queries.

Quantum has sought responses from ICICI Bank and ICICI Securities within five days, failing which it would take “appropriate legal proceedings”, according to the communication. The fund house has also asked both firms not to act towards the implementation of the scheme of merger.ICICI Bank had defended the scheme of arrangement on the grounds that it was recommended by independent valuers.Quantum has disputed the claim saying the valuation reports have not only ignored current market peer comparison data but also failed to disclose the basis of the valuation and the information based on which the valuation reports have been made.

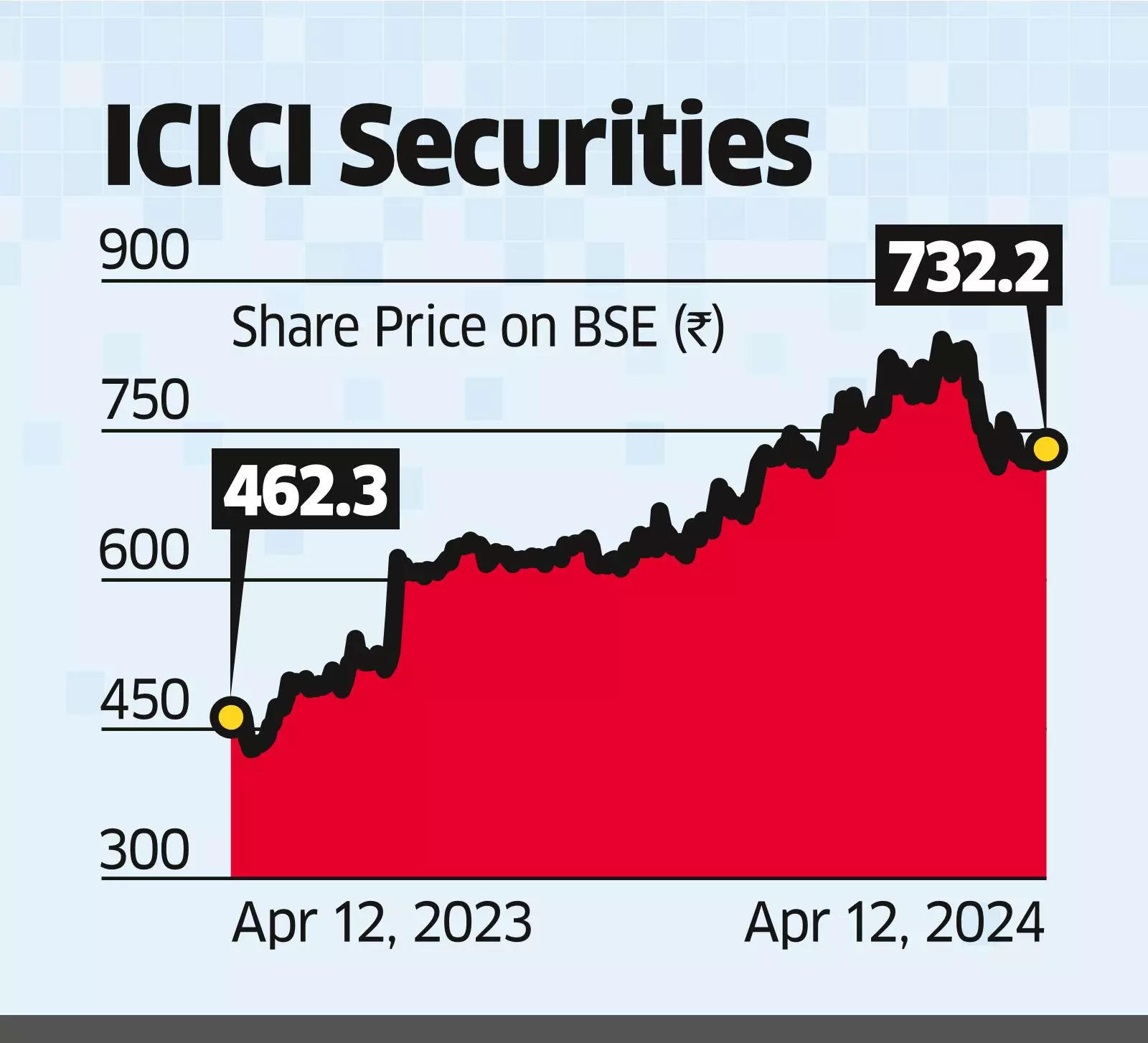

“ISEC has seen a spectacular 66% growth in net profits for the quarter ending December 2023; however, the share price has barely moved due to the cap limit placed by the arbitrary and unjust swap ratio.”

Quantum also alleged that the majority voting in favour of the scheme of the merger had been achieved by “fraudulent means” by ICICI Bank.

“Prior to the voting, we were shocked to learn that the management of ICICI Bank was contacting the retail shareholders of ISEC and coaxing them to vote in favour of the Scheme of Merger,” it said. “This disclosure of confidential shareholders data on the part of ISEC to ICICI Bank shows the mala fide conduct of ICICI, which vitiates the shareholder’s meeting and votes.”

In a clarification to stock exchanges, both ICICI Bank and ISEC claimed that the outreach to the shareholders was to facilitate maximum voting participation.

Last month, the scheme of arrangements was approved by the public shareholders, with 71.89% voting in favour of the resolution, while only 28.11% voted against it. ICICI Securities shares will soon be delisted from the bourses, with shareholders receiving 67 shares of ICICI Bank for every 100 shares held.

[ad_2]

Source link