[ad_1]

CDMO players have been in focus for a while. We have had these discussions about growth prospects for these companies going forward. What is your outlook on the CDMO and CRO players? How is it looking interesting? From where will the growth drivers come?

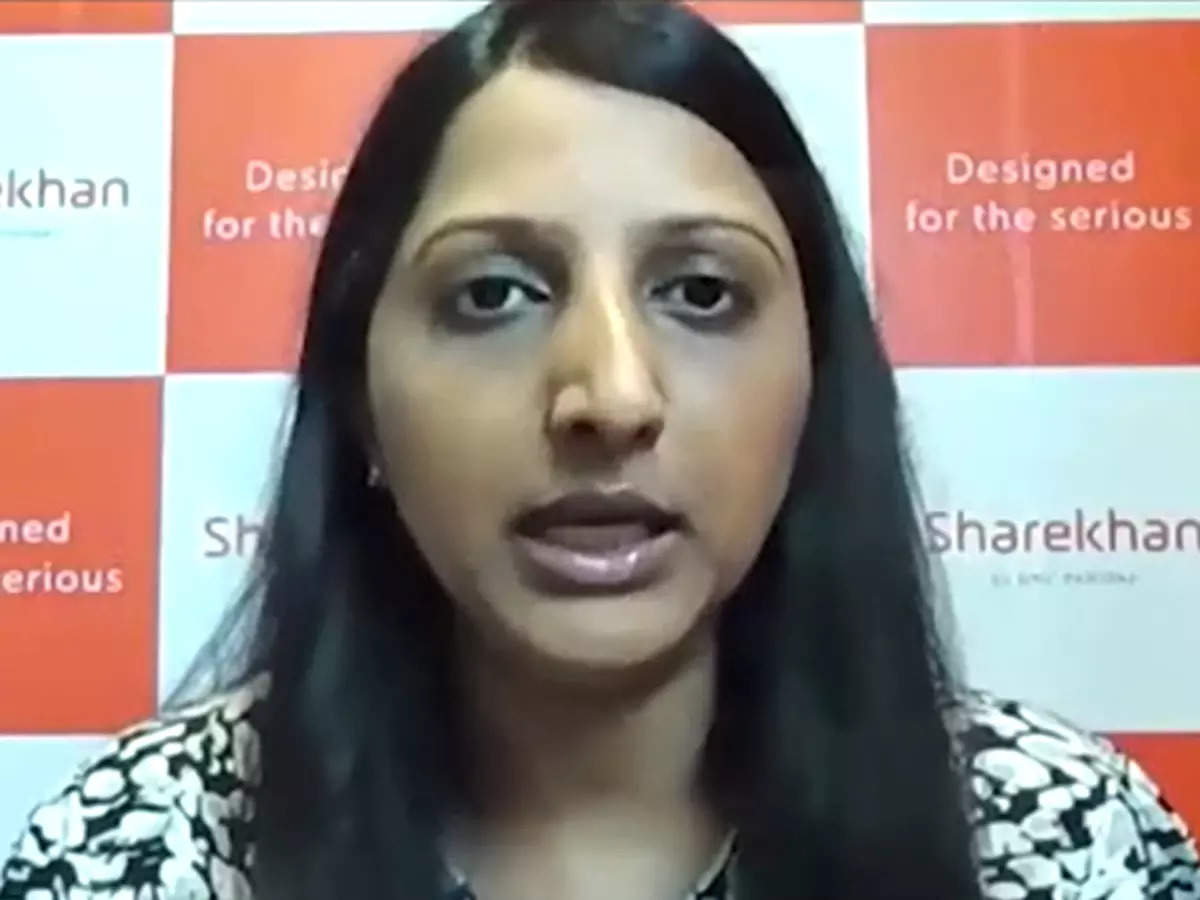

Foram Parekh: CDMO companies are witnessing a lot of inquiries because of China plus one opportunity. We will say that Europe plus one opportunity is also playing out well for these companies because we have cheap labour and most of our plants are US FDA compliant. All that is auguring well for the CDMO companies.

Unlock Leadership Excellence with a Range of CXO Courses

| Offering College | Course | Website |

|---|---|---|

| IIM Lucknow | IIML Chief Operations Officer Programme | Visit |

| Indian School of Business | ISB Chief Technology Officer | Visit |

| IIM Kozhikode | IIMK Chief Product Officer Programme | Visit |

Also, the Biosecure Law which could be passed in the US and if that gets passed, then most of the companies will come to us rather than the Chinese companies. Basically, the China plus one and Europe plus one inquiries coming into these companies will be executed fast once the Biosecure Law gets passed in the US.

But having said that, most of these CDMO companies have corrected well enough and the Covid base is also over. So, probably the new molecules and the capex cycle will start for these companies. In the CDMO space, we like Divi’s and we believe that the current correction has augured very well and most of the Covid base in the Divi’s is now behind it and the new molecules and margins will pan out for Divi’s from the next quarter onwards.

What could derail this story because there are a lot of positive murmurs, whether it is about the biotech funding environment and the kind of China plus environment which is working out, but what do you think could be the impediment stocks like Laurus, etc, have already run up ahead of expectations? At least that is what some of the analysts are suggesting as well.

Foram Parekh: We have a reduced rating on Laurus. We would like to see earnings improvement in the company, though management has given a lot of positive commentary on the stock about its new capacity coming on board, we would like to see numbers playing out for Laurus.

But having said that, the derailment could be execution of these inquiries, irrespective of Biosecure Law getting passed. But then whatever orders we are seeing need to be executed fast enough, capacity needs to be expanded quickly to have those additional inquiries being executed. So, we feel that the companies that have good capacity in place like Divi’s would be the quick beneficiary of the CDMO play. But companies which delay in setting up new capacities, would take some time to pan out on the earnings numbers.Do you track Sun Pharma and the kind of slide that we are seeing on the stock today? The Dadra facility was not expected to have a big impact. What is your reading, a 4% cut?

Foram Parekh: So, we have coverage on Sun Pharma. The Dadra facility has received an OAI and that is negative for the stock. Sun is basically a specialty focused company now and I believe that Dadra facility does not contribute much to the Sun’s earnings. But having said that, we have a positive view on Sun Pharma because specialty sales are doing very well, not just in the US, but globally. Even at a higher base, the management is very confident of retaining its 20% odd growth in the speciality sales. Also, specialty sales are picking up very well, which was earlier 15-16% of the sales have now inched up to 20% of the sales and it is only expected to go further up. Apart from specialty sales, the Taro business is doing good and domestic is doing good for Sun Pharma. Domestic continues to grow in double digits led by volume growth. We believe this current correction in Sun Pharma offers a very good buying opportunity.

Other than that, anything interesting that you are finding in the pharma pack? Where could one expect fundamental growth coming in from the companies?

Foram Parekh: Apart from Sun Pharma, we like all the largecaps – Dr Reddy’s, Lupin and also the Revlimid players, like Zydus, Sun, Cipla. They will benefit from the Revlimid sales until January ‘26.

Also apart from Revlimid sales, Lupin has launched Spiriva in the US market and there are no competitors expected to be in this drug at least for the next two years and Lupin has picked up on its earnings very well. It had lost 5% EBITDA margin last year in Q1. From there, because of the Spiriva drug and other new product launches, EBITDA margin is now climbing towards 20% and we feel that this will continue to go up for Lupin.

Also, its Pithampur Unit 2 which was under OAI for a very long time has got clearance and through this plant, ophthalmic products will get launched with many first to file opportunities. Lupin is one stock which we feel has a very good potential despite the steep rally and we have a target price of Rs 1868 on Lupin. Having said that, Dr Reddy’s is also a very good buying opportunity because of Revlimid and restructuring.

[ad_2]

Source link